Wednesday, March 31, 2010

Financial Planning- how far does it help?

My question here is on the importance and extent of financial planning. I do understand that it's the sensible thing to do but it doesn't change the fact that many things today still are controlled by market forces or induced forces, the answers to which not any financial planning can come up with but the larger understanding of the power and sensible use of money by the Government.

Benefits of Sinning.

What caught my attention here was finding a connection between the principle of Game Theory popularised by Dr. John Nash, who inferred that performance of one player directly affects the performance of the other, and the given form of tax. In the case of the imposition of the Sin Tax, the government totally depends on the decision of the other player, the consumer, to reap the benefits of tax. This would also be indicative of the government making money out of the "not so good" consumer decisions but from the economic perspective it generates revenue in the form of tax. Now though this may seem like a one sided game benefiting only the government, it reminds me also of another theory by Adam Smith which states that the best results in a group come from everyone doing what's best for themselves and the group. Now what puzzles me here is the criteria for judging what's best for the two parties (the government and the consumer), obviously liquor and tobacco and alcohol can't do much justice being termed good but yes income for government does stand good. The tax thus can be viewed from two perspective: The Game Theory perspective allows the government to benefit only when the other player makes the expected move and Adam Smith's theory of doing what's best for all so that both the parties benefit, gives another dimension of viewing it, the definition of benefit though remains ambiguous.

Wednesday, March 17, 2010

The Preview of The Mind

Thursday, February 4, 2010

Why do we have firms at all?

Having said this, I am compelled to state the obvious question raised by David Smith in his book Free Lunch as to why do we have firms at all, given that we consume as individuals, why can't we produce the same way?

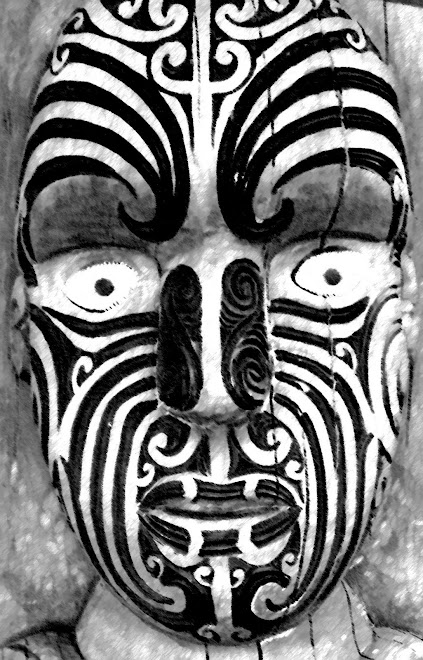

And he answers the question for us stating that about 3 million people are self employed in Britain and most of the businesses that grow up to be large enterprises start up as a one man business. As the business grows, there is requirement for more man power and skill and entrepreneurship, but of course there are some that prefer to remain a one-man business. The reason why most people choose to be self employed can be attributed to security of employment. But data states that majority of people work for others and this as stated by Adam Smith is due to factors like specialization, the division of labor, increased efficiency resulting in lower costs. A sole trader could still produce the same thing but will be incompetent in the factory price area. This could possibly be the reason for the existence of firms, they lower the final cost of the product sold. Sole traders though can still charge the high price sticking to the motto : you pay more but you get something better, or at least more individual. This holds true in the case of Art and Sculpture (among others of course). Because of the high level of skill and attention to detail involved and the "individuality" factor coming into play, it is not surprising to note that we haven't seen very many "large firms" dealing with the direct creation of art (eg. Maori Art Sculpture to name the most evident one present in New Zealand) as we see a sole trader or for that matter a small business deal with it.

It therefore would not be wrong to state that though the economies of scale is lower for small enterprises as compared to their larger counterparts, there are still existing areas where the small business dominates and despite the huge earning potential available empirical data suggests that big firms haven't found a firm footing into those sectors.

Sunday, January 24, 2010

Boons of Small Enterprises

This example further highlights the theory that small enterprises are better equipped to introduce new technology or ideas as compared to their larger counterparts who proceed with any new innovation ONLY when the larger market appears assured. Sometimes it’s advantageous to start with a small market segment and build up a brand name through word of mouth and then expand. Empirical studies show that this rarely happens in the larger firms as their production structure is not very flexible owing to their economies of scale.

(source: CnnMoney.com/SmallBusiness2009)

Sunday, January 10, 2010

Understanding Small Enterprise Finance

They infer that Finance is a well developed body of idea based on the neoclassical economic principles, three of which act as its backbone.

1. Time is money:

This concept coined by Fisher explains the time value of money in terms of compound interest, discount rate and the likes, which can further be developed mathematically to support areas like project appraisal and so on.

2. Don't put all your eggs in one basket:

The idea behind surrendering the eggs to not one but several baskets (the ingenious thought of Markowitz) was actually the lesson on diversification, which now is generalized into the Capital Asset Pricing Model or CAPM.

3. You can't fool all the people all of the time:

Modigliani and Miller discovered the all so obvious but less thought of fact, that in the presence of perfect competition and profit maximization and zero individual influence on price, it was nearly impossible to have market efficiency and arbitrage.

while the assumptions (the food and fodder for economics) may turn out to be otherwise at times, the fact remains that they DO constitute a very strong base to the theories that have the impeccable ability of great predictions!

Tuesday, January 5, 2010

Where are my twenties going?

That's the question everyone seems to be asking around me. Not to mention that everyone I ask the question to either counter-questions me or says ,' If only I knew'. Why the sudden need for everyone to know where their lives are headed? I mean, did we care where life was going when we were 10? No. Did we care where life was going when we were 17? No. It only hits hard at when we hit that despicable number - Twenty. Then everyone's suddenly talking utter tosh about climate change and marriage and turning relationships long-term and money and investing and blah, blah, blah... If you ask me, it doesn't even matter. None of us know what's going to happen anyway.

The only thing I know is this - if I waste all my time worrying in my twenties, I'm going to be doing something worse when in my thirties.

REGRETTING.

Now that's something I don't ever ever want to be doing.